Beijing Airport Customs Clearance Guide for Export Returns

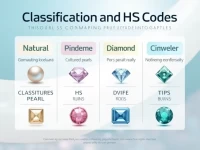

This article focuses on the issue of export returns, using Beijing Airport as an example. It elaborates on the operational procedures and precautions of export returns from ten aspects: analysis of return reasons, timeliness management, identification of trade methods, export tax rebate processing, subsequent cargo handling, document preparation, foreign exchange management regulations, special cargo declaration, terminal and warehousing selection, and customs broker selection. The aim is to help foreign trade companies efficiently and compliantly handle return matters and minimize losses.